Moving to Spain

Talenom International Mobility is your comprehensive solution for all your legal and administrative requirements throughout your journey in Spain.

From planning the move to making it a reality, we take care of your day-to-day needs once you're settled.

Planning

During the planning phase, we will assist you in determining the most suitable residency and work permit options if you are a non-EU citizen. Additionally, we recognize the importance of understanding how the move will impact your tax residency and aim to optimize your tax burden accordingly.

We can provide guidance on strategic timing, such as leveraging moving dates to minimize taxes in the most cost-effective country. We can also advise on asset sales timing and explore potential benefits offered by the Beckham law. Our goal is to ensure you make informed decisions that align with your financial objectives and legal requirements.

Implementation

When it comes time to take action, one of our top priorities is to assist you in organizing your initial paperwork. Dealing with Spanish bureaucracy can be daunting, but we are here to streamline the process and save you valuable time and money by handling the necessary paperwork on your behalf. By taking care of these essential steps, we ensure that you can settle smoothly and focus on other aspects of your journey in Spain:

- “Green” NIE for Europeans, work & residency permit for non-Europeans

- Taxpayer registration

- Bank account & anti-money laundering clearances

- Digital certificate

- Organizing registration at the city hall

Talenom International

Mobility provides

Talenom International Mobility specializes in providing immigration advice primarily for investors, entrepreneurs, and companies seeking to hire international talent. While we can assist with various immigration-related matters, our expertise particularly shines in the following areas:

- Golden Visa

- Digital nomad visa

- Non-lucrative visa

- Entrepreneurial residency

- Hiring non-EU talent to work in Spain

- Intra-company transfers of employees

- Spanish citizenship

Are you looking to lease

or purchase in Spain?

In recent years, our clients have achieved successful investments totaling over 200 million euros in Spain. If you are considering a property purchase, we offer various ways to assist you.

Once you have identified a potential real estate asset and completed the initial paperwork, determining the optimal ownership structure and financial flows becomes essential.

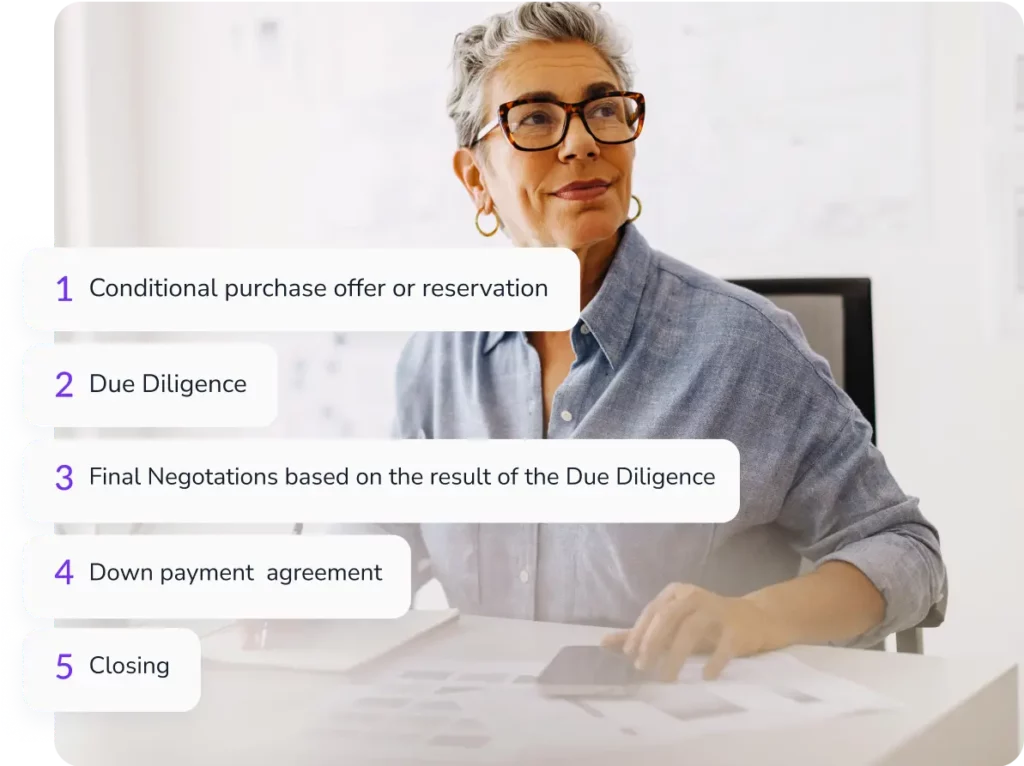

The legal process of a real estate investment in Spain typically involves five crucial steps.

Each of these steps is significant in ensuring your rights

are maximized while minimizing obligations, costs, and taxes. Conducting thorough due diligence is vital to avoid costly errors and gain a clear understanding of the property. It also provides strong arguments to negotiate the most favorable terms for the deal. The down payment agreement plays a pivotal role, as it sets the foundation for finalizing the transaction. Finally, the closing stage offers a last opportunity to address any remaining matters and ensure a smooth completion of the operation.

We’ll provide comprehensive support throughout the entire process, treating your investment as if it were our own.

Day-to-Day

After you have settled down, we will be with you every step of the way for your legal and administrative needs in Spain such as tax declarations, permit and certificate renewals, and providing legal support when required.

Our team at your service

Our tax advisors in Spain, along with the other experts at Talenom International Mobility, are highly skilled and dedicated professionals who share our mission, vision, and values. They are not only fluent in multiple languages but also possess a deep understanding of various cultures. As digital natives, we leverage technology to deliver efficient services. Our team is driven by an entrepreneurial spirit, and many of our tax advisors have extensive experience working in renowned Big Four firms. With their international expertise, you can rely on us to optimize your Spanish tax obligations and minimize your tax burden effectively.