Moving to Spain

Talenom International Mobility is your one stop shop for all your legal and administrative needs during your journey in Spain.

We can help you to plan the move, make it happen and take care of your day-to-day needs once you have settled.

Planning

While you are still planning the move, we will figure out what is the best residency and work permit for you if you are a non-EU citizen.

Another crucial point in the planning phase is to understand how the move will affect on your tax residency, and how to optimize the tax burden in consequence. How to play with the dates of moving to pay the taxes in the least expensive country? Should you sell assets before or after the move? Can you take advantage of the Beckham law?

Implementation

When it is time to act, the first thing on the agenda is to get your initial paperwork in order. The Spanish bureaucracy can seem overwhelming. We will save you time and avoid costly mistakes by taking care of the bureaucracy for you. With these steps you are nicely settled:

- “Green” NIE for Europeans, work & residency permit for non-Europeans

- Taxpayer registration

- Bank account & anti-money laundering clearances

- Digital certificate

- Organizing registration at the city hall

Talenom International Mobility provides

Talenom International Mobility provides immigration advice mainly for investors, entrepreneurs and companies hiring international talent. We can handle any immigration related matter, but excel specifically in:

- Golden Visa

- Digital nomad visa

- Non-lucrative visa

- Entrepreneurial residency

- Hiring non-EU talent to work in Spain

- Intra-company transfers of employees

- Spanish citizenship

- Brexit

Are you renting

or buying?

Over the last few years our clients have invested successfully over 200 million euros in Spain. If you are buying a property, we can help you in many ways.

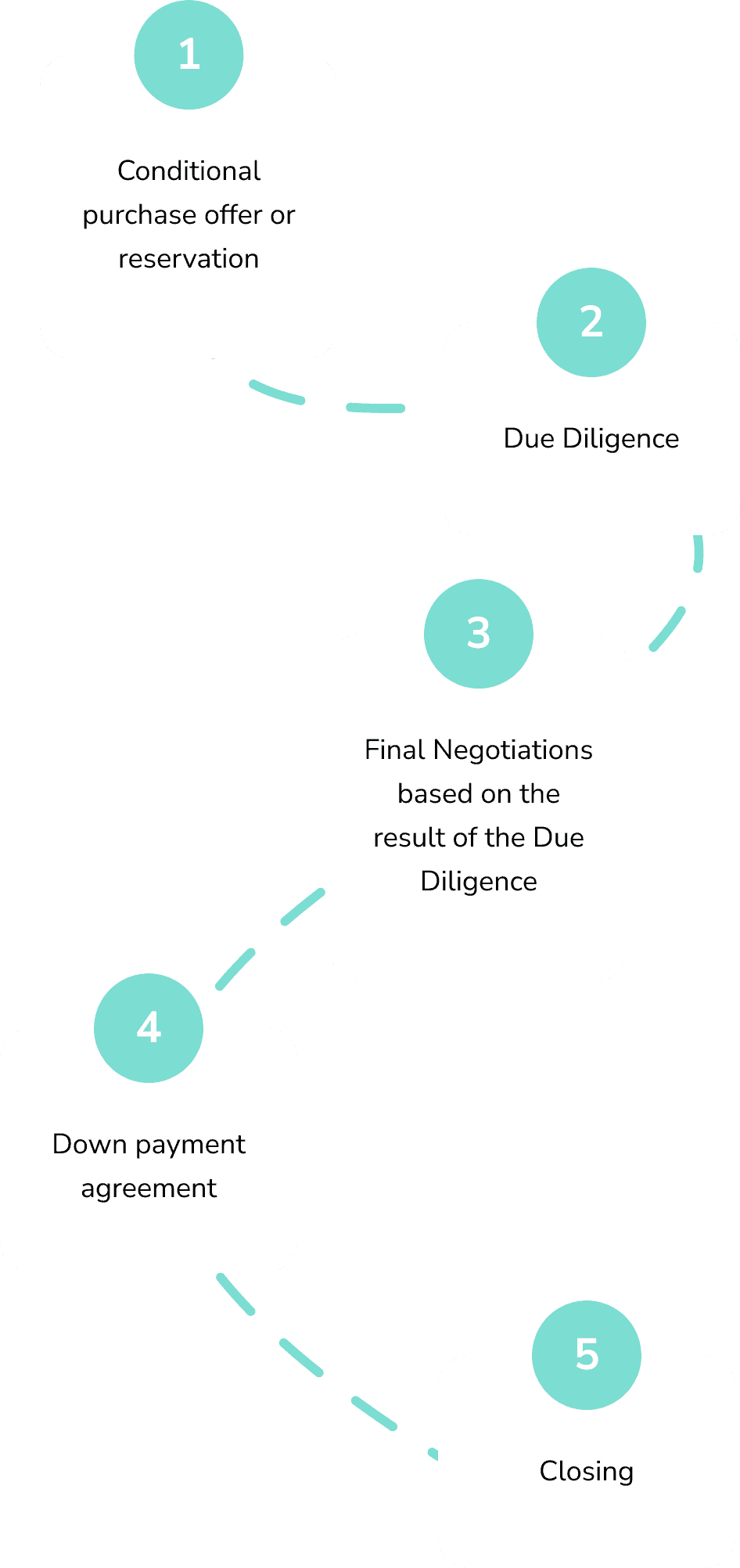

Once you have identified a potential real-estate asset, completed the initial bureaucracy, and the optimum ownership structure & money flows are clear, the legal process of any real-estate investment in Spain consists normally of five steps.

To invest successfully, every one of these steps is important to maximize your rights and minimize your obligations, costs and taxes. A proper due diligence is crucial to avoid costly mistakes and make sure you know exactly what you are buying. It also provides the arguments to negotiate the best possible terms for the deal. Down payment agreement is vital since most of the final terms are agreed upon at this point. The closing is the last opportunity to tie up any loose ends in the operation.

Day-to-Day

Once you are settled, we’ll accompany you in your everyday legal and administrative challenges, like for example declaring your taxes in Spain, renewing your permits and certificates, and having our lawyers to defend you should you need some support.

Our team at your service

Our tax advisors in Spain as well as the other professionals of Talenom International Mobility are multi-lingual, multi-cultural, and committed to our mission, vision, and values. We are digitally native, and entrepreneurially led. Our professionals know the ins and outs of the international and Spanish taxation. Many of our tax advisors come from Big Four firms. With their international expertise, you and your business can optimize the amount of Spanish tax you need to pay.