It is possible to do contract invoicing in Easor App. Changes to the VAT rate must be made both for existing contracts and for invoices that have already been formed and are awaiting shipment. Below are instructions on how to make updates.

Customers

The default information defined in the customer register replaces the information defined in the contract (sales account and dimensions). Therefore, the customer information of customers invoiced with contract invoices must be checked to see if the customer has a customer-specific sales account. If changes need to be made to the customer information, see chapter Customer register.

Products

Products used on contract invoices must be updated with the new VAT rate in the product register. Instructions for this can be found in chapter Product register.

Contracts

The VAT changes must be updated for both the contract and the already formed contract invoices waiting to be sent. Here’s how to make changes to the contract.

- Go to the Contract invoices tab.

- Select Edit contract invoice from the pen icon to open the settings for that contract in separate tabs.

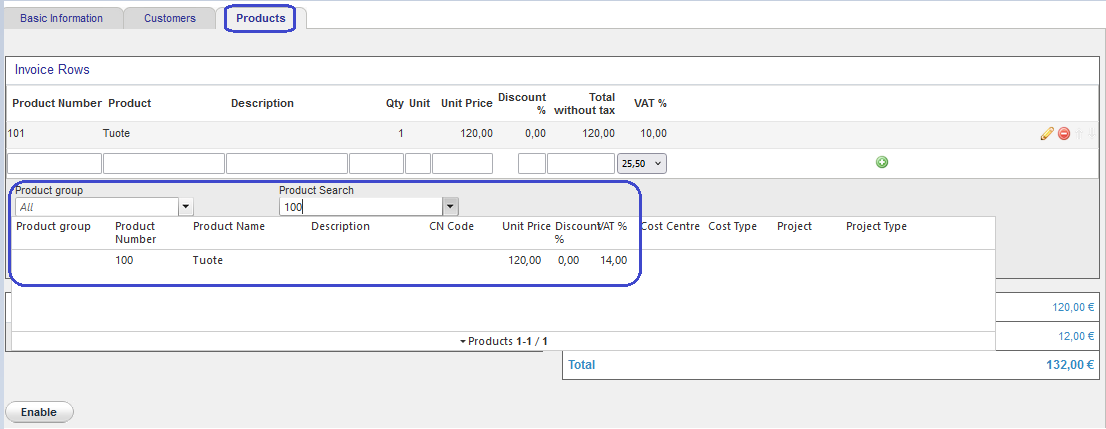

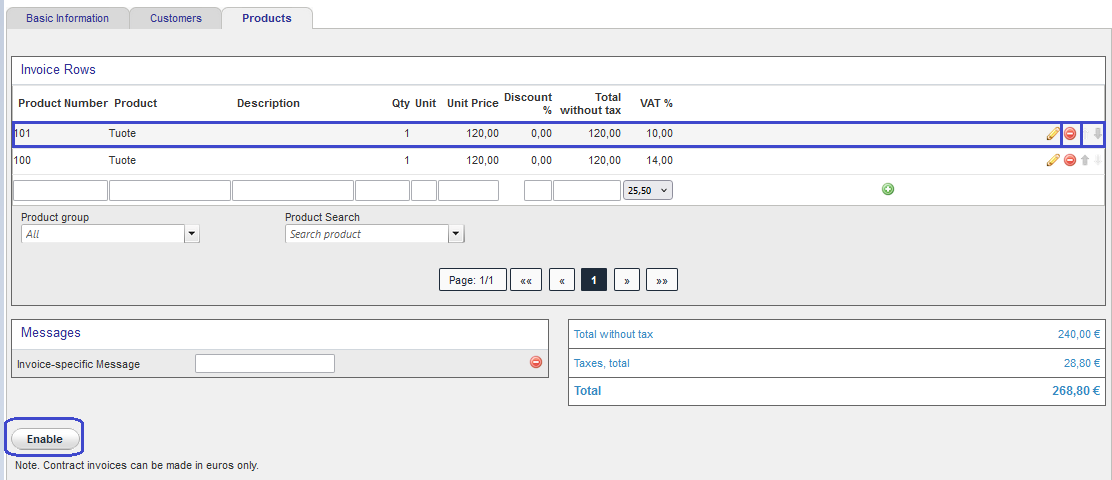

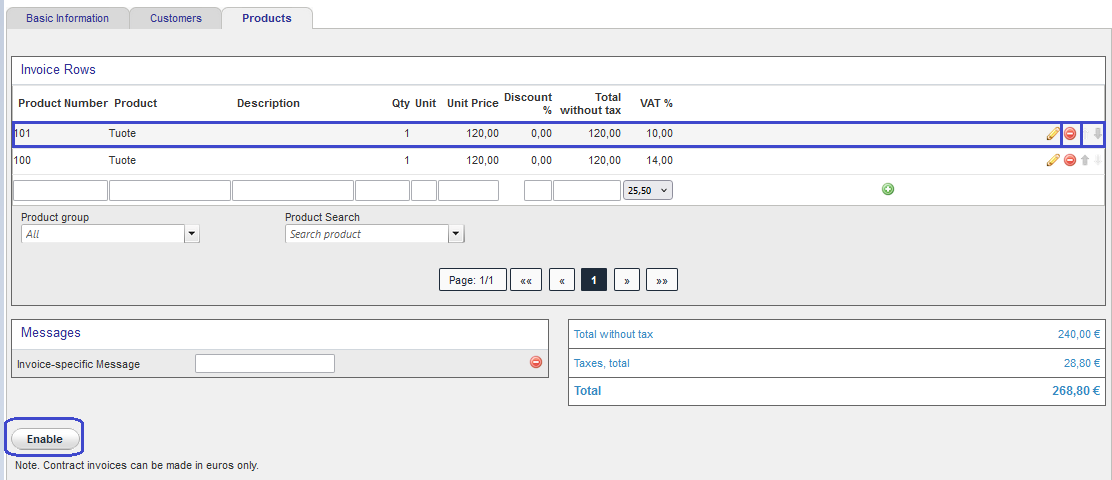

- Go to the Products tab.

- Search for the product on the contract and add it as a second product line.

- Delete the product line with VAT % 10 and select Enable.

- The contract has been updated and the next contract invoice is formed with the new VAT rate. The update does not affect an invoice that has already been generated, so please update the generated invoice.

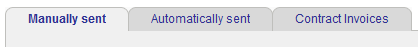

Manually and automatically sent contract invoices

- Go to the Manually sent or Automatically sent tab.

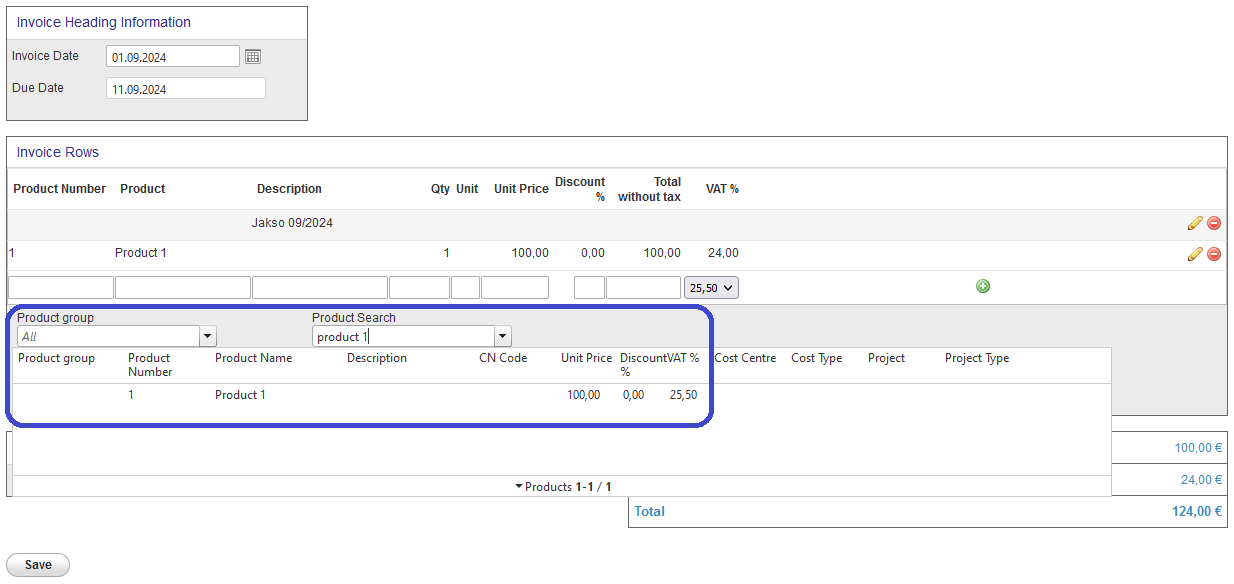

- From the pencil icon, select Edit invoice.

- Search for the product on the contract invoice and add the product to the invoice again as a second product line.

- Delete the product line with VAT % 10 and select Enable.

- The outgoing contract invoice has been updated.

If you do not have a product register, manually add a new product line to the invoice.