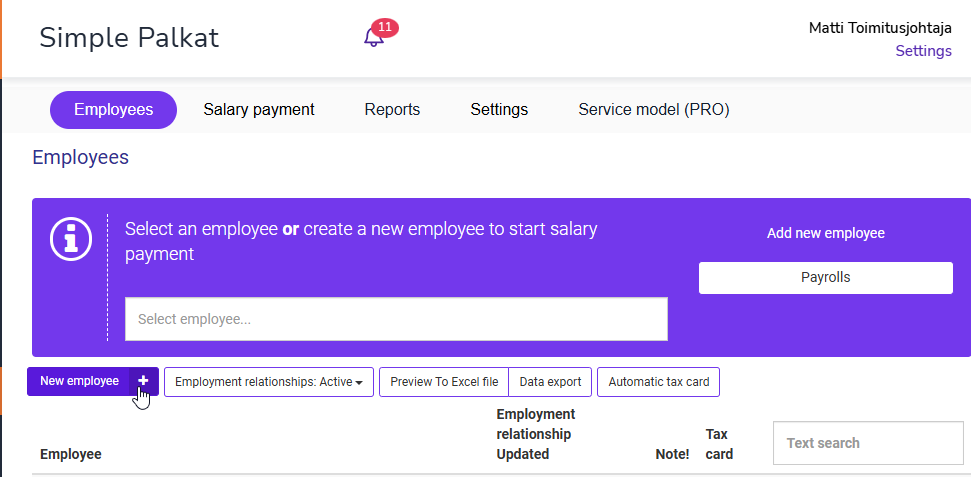

Add a new employee from the New employee button on the Simple Salaries home page. An entrepreneur’s details will also be added from the New employee button.

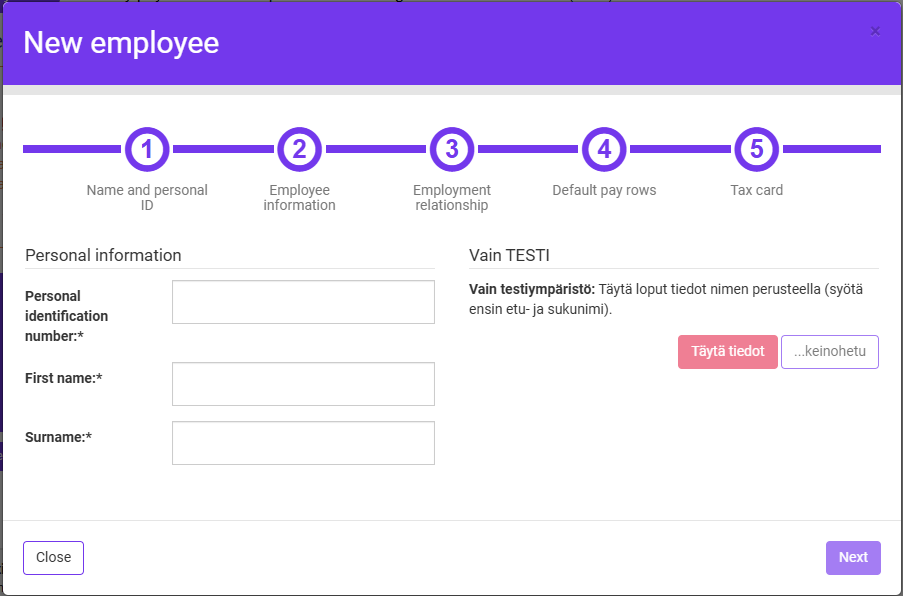

Name and personal ID

On the Name and personal ID tab, enter the employee’s personal identification number, first name and surname.

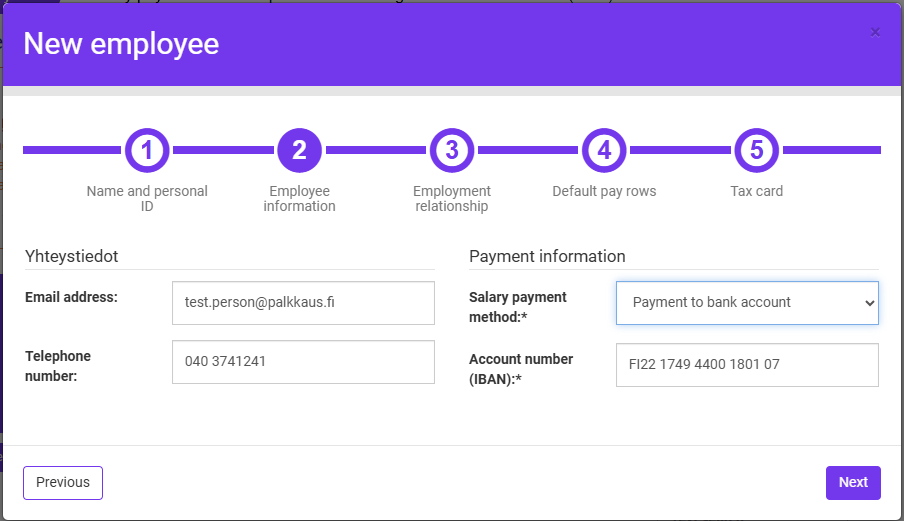

Employee information

On the Employee information tab, enter the employee’s email address, phone number, method of payment, and the account number to which the salary will be paid.

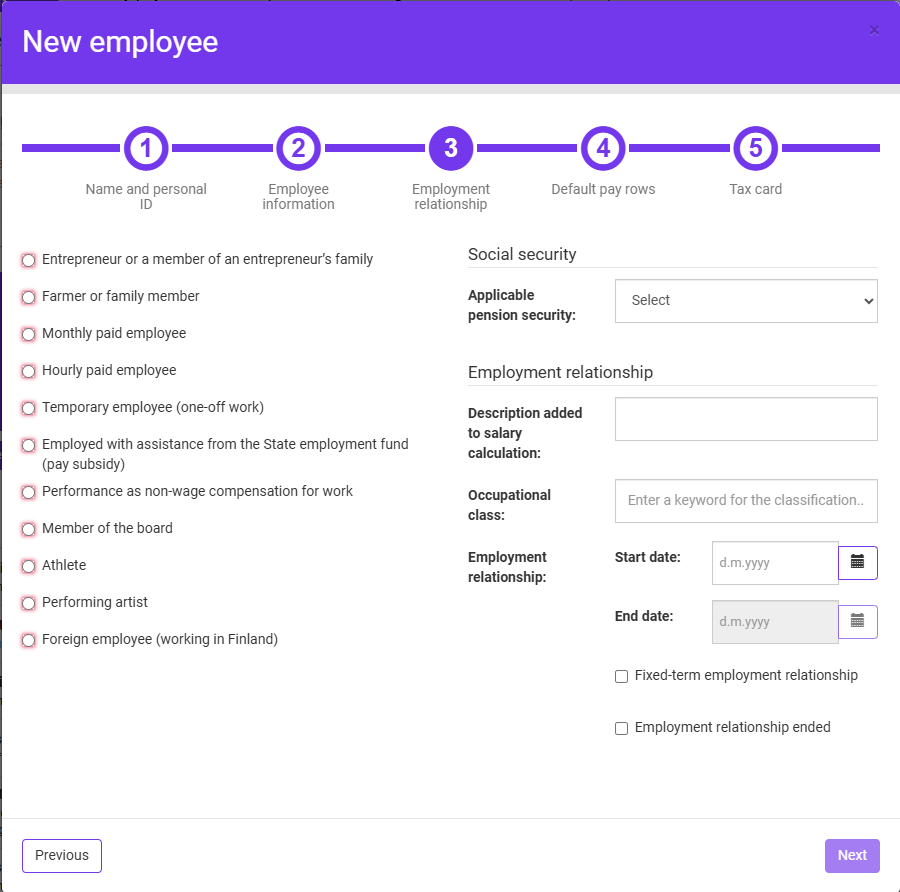

Employment relationship

On the Employment relationship tab, select the type of the income earner, the applicable pension security, the start date of the employment relationship and, for employees covered by TyEL, the occupational class related to the accident insurance. The description on the salary calculation is an optional text field.

The accident insurance company charges the employer according to the occupational class chosen, as the premium is determined by the accident risk associated with the job. It is therefore important to choose the occupational class carefully and correctly. If necessary, you can use the classification tool managed by Statistics Finland.

If you known that the employment relationship is fixed-term, select the Fixed-term employment relationship setting and define the end date for the employment.

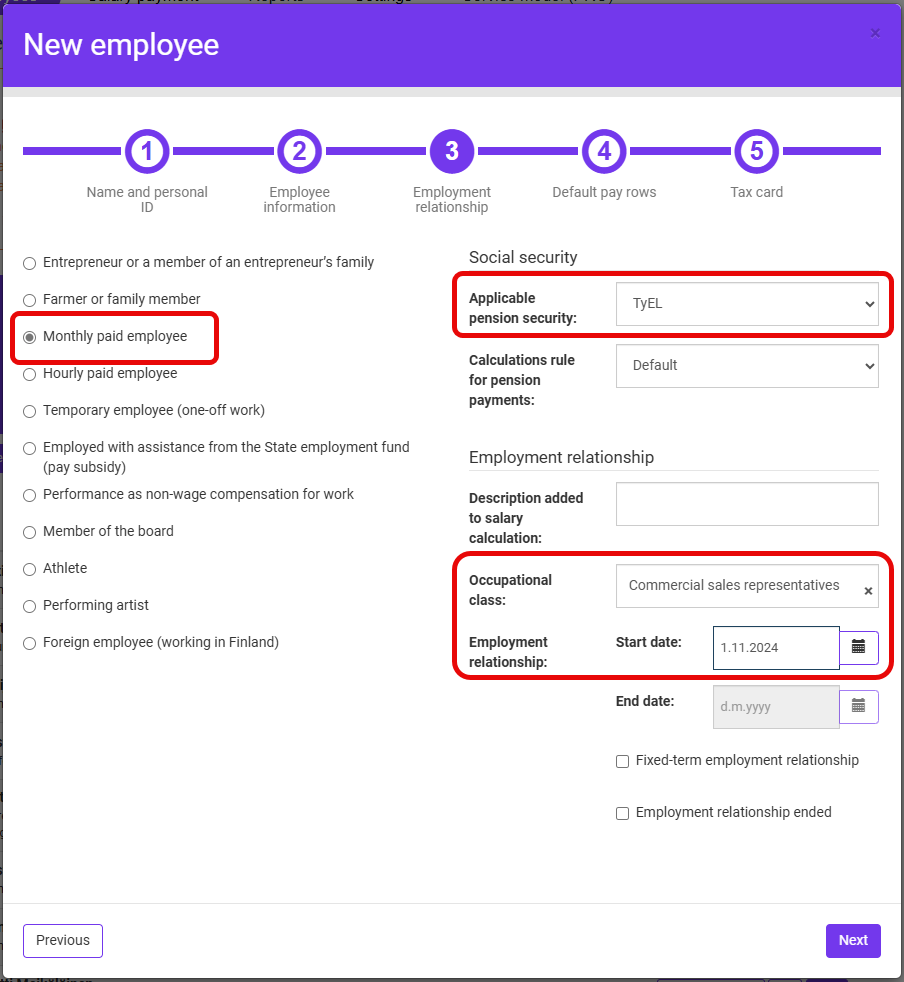

Example, employee (TyEL)

A sales representative will start as an employee. Select Monthly paid employee as the type of income earner. Simple Salaries automatically proposes TyEL as the applicable pension security. Select the employment start date and select Commercial sales representative as the occupational class.

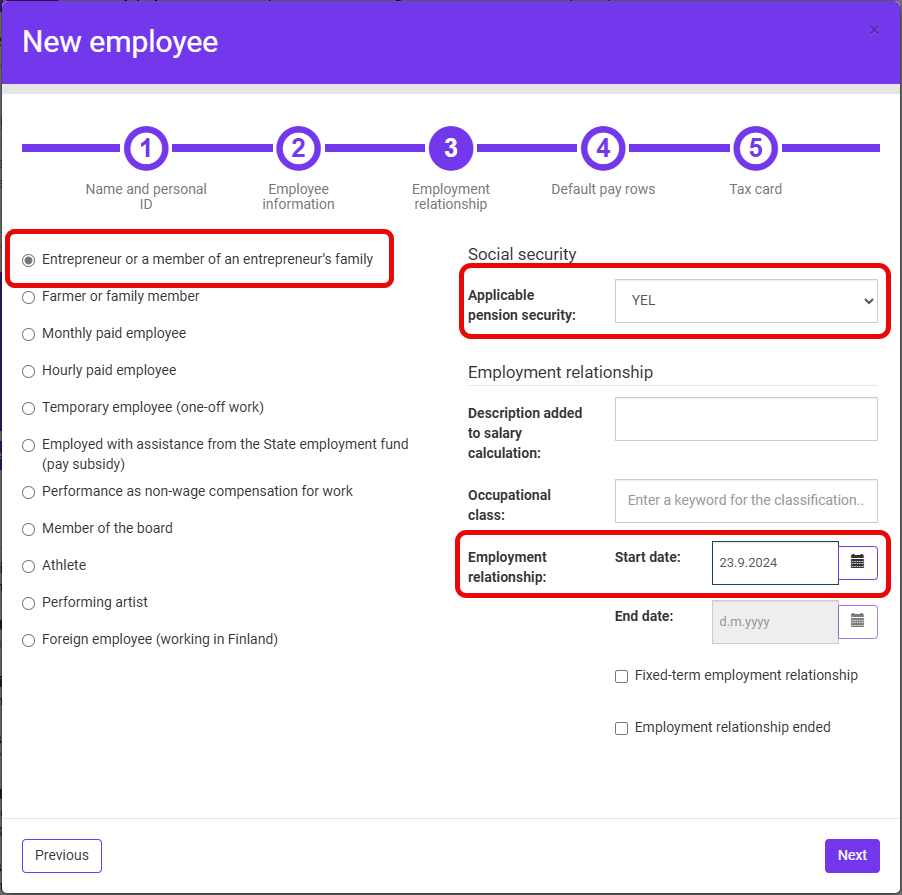

Example, self-employed person (YEL)

If you select Entrepreneur or a member of an entrepreneur’s family as the income earner type, Simple Salaries will automatically suggest YEL as the applicable pension security. In case of partial owners, the applicable pension security must be changed to TyEL, partial owner. No occupational class is selected for the YEL entrepreneur, as YEL entrepreneurs are not obliged to take out an accident insurance.

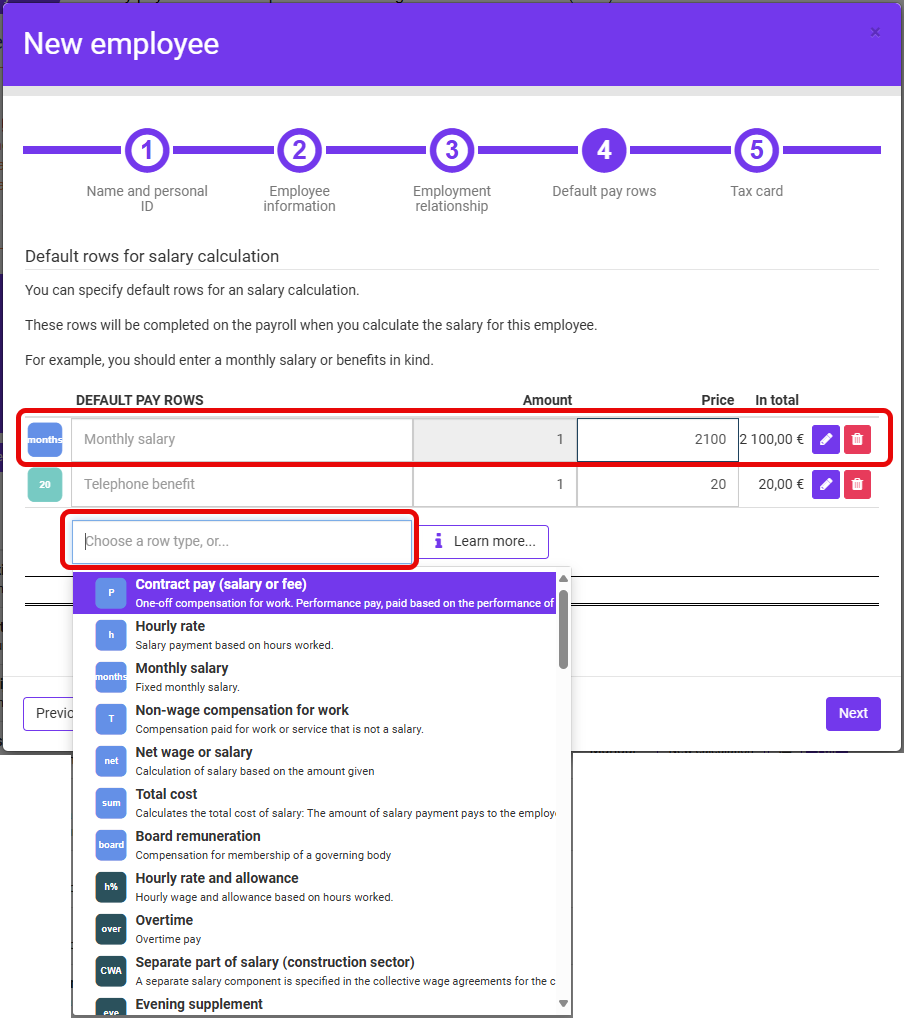

Default pay rows

On the fourth tab, default pay rows can be added on the salary calculation. These rows will always appear by default when the salary is paid. In the Price field, you can define the unit price of the pay type, e.g. monthly salary €2,100.

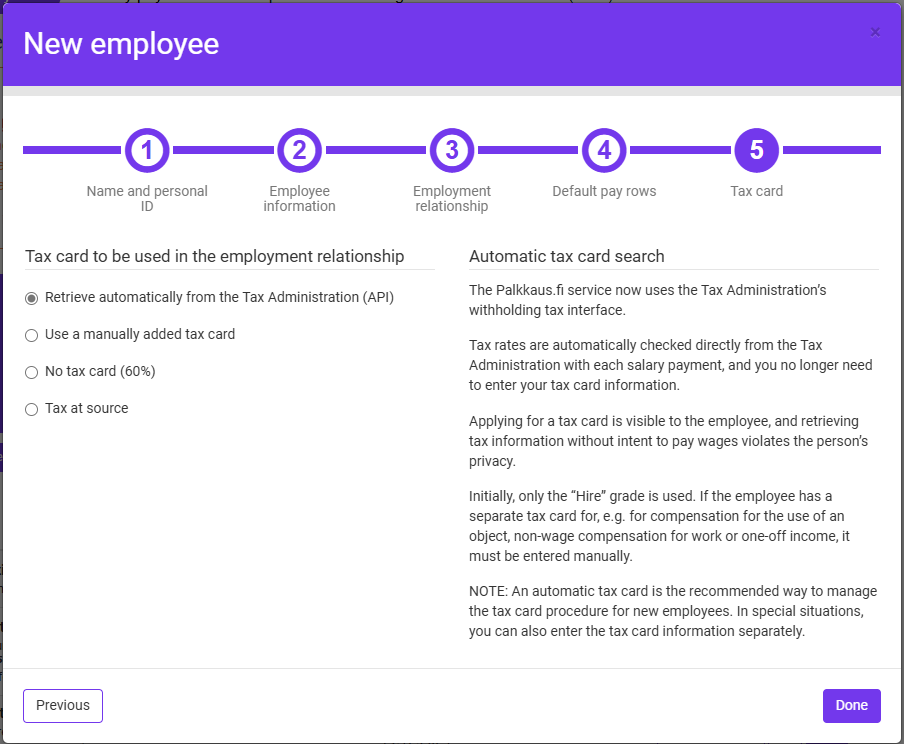

Tax card

On the fifth tab, select the method of delivery of the tax card. The default option is Retrieve automatically from the Tax Administration (API), which retrieves a valid tax card directly from the tax authorities’ interface. The tax card will then be updated for each calculation.