In Talenom Online you can receive purchase invoices with 24% and 25.5% VAT rates. The processing of purchase invoices will remain the same as before and the invoice circulation and definition of possible dimensions, such as cost centers, must be done either in Payments or Invoice payment – old in Talenom Online. Special attention should be paid to the verification of purchase invoices when the VAT changes and the vendor should be informed of incorrect VAT rates on purchase invoices.

Posting in the Invoice payment – old service

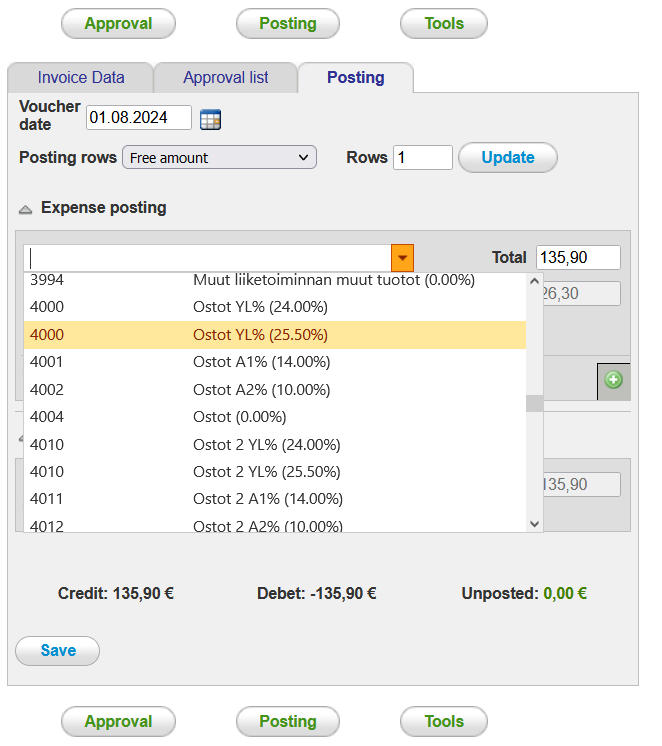

The Posting tab is visible only to users who have posting permissions. Talenom has added a second expense account with VAT rate of 25.5% with the same name and number than the company’s existing 24% expense account. This means that the user does not need to request the creation of a new account for the 25.5 % VAT rate.

The person posting the invoice is responsible for ensuring that the invoice is processed using the correct VAT rate, so when posting an invoice, it is important to select the correct expense account from these two VAT rates.

If the invoice has a posting suggestion, the posting line of the invoice must be deleted to show the account menu.

In Talenom Online, the invoice date has no effect on the VAT rate selected, i.e. the program does not automatically update the VAT rate on the invoice based on the invoice date. When posting an invoice line, the user must select the expense account and VAT rate to be used based on the content of the purchase invoice.

- If the invoice is posted with the date 1.9.2024, the invoice will not automatically change to the VAT rate of 25.5%.

- The same invoice can have invoice lines with both VAT rates of 24% and 25.5%.